Ira-approved Gold Investment For Retirement Asset

You probably understand about the idea of inflation, in which the value of the dollar continually decreases gradually. It costs a lot more to purchase a 1,000-square-foot house today than it did 50 years earlier. As an outcome, all the paper financial investments you hold need to increase in value by a higher rate than the inflation rate to stay lucrative.

Gold costs fluctuate regularly due to supply and require, the quantity of gold in bank reserves, and financier habits. As a result, when the dollar's worth falls, the cost of gold typically increases. Gold provides deflation security. In addition to hedging versus inflation, gold can likewise safeguard your possessions against deflation.

Gold is a reasonably stable place to keep one's cash, leading the buying power of gold to increase during the Great Depression and other considerable durations of deflation. Gold can diversify your financial investment portfolio.

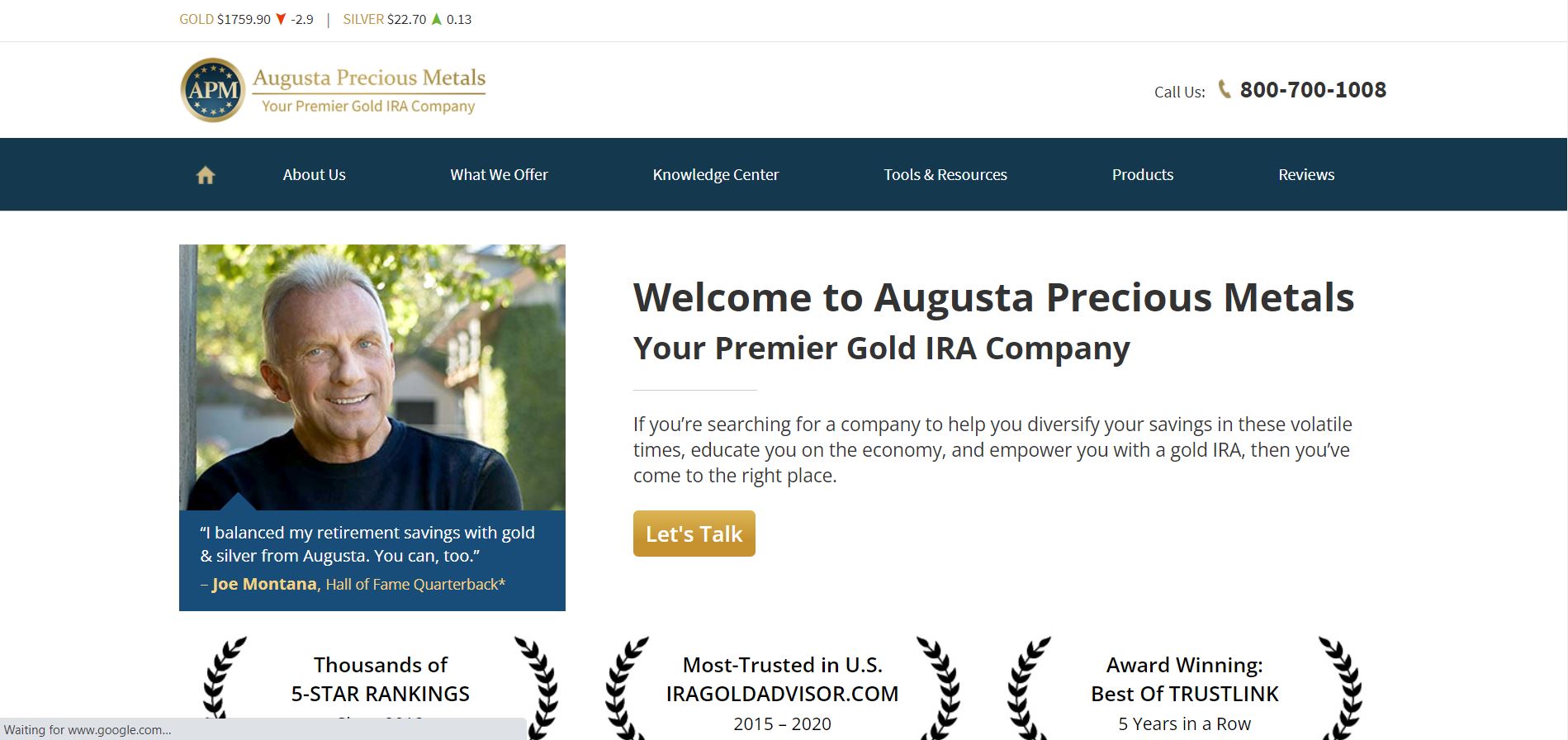

Best Gold Ira Companies

Diversifying your portfolio can help you manage danger and minimize the volatility of your asset prices. One simple method to diversify your investments is to buy a gold individual retirement account in addition to your standard retirement properties. Comprehending a gold individual retirement account rollover The majority of the gold IRA companies on our list do not allow you to open a gold individual retirement account from scratch.

This latter alternative is called a gold individual retirement account rollover. IRA rollovers need to conform to specific rules and regulations from the IRS. If you pick to roll over funds from an IRA, you can not hold those funds in your account for longer than 60 days prior to investing them into a new IRA.

Rolling over an IRA is a more involved procedure than moving funds from one individual retirement account to another. self directed ira. Rollovers tend to be faster than transfers, taking location in 60 days or less in many instances. The business on our list can help you facilitate gold individual retirement account rollovers to make the process as seamless as possible and make sure that you do not deal with any additional charges due to misguidance.

3 Best Gold Ira Companies In 2022

Many gold Individual retirement account companies have their own minimum financial investment requirements that you need to satisfy to work with them. If your existing retirement accounts have actually not accrued much worth considering that you opened them, you might want to look for a gold IRA company with a low minimum investment requirement.

When you invest in a gold IRA, you can not keep the physical gold bullion at house. Rather, the internal revenue service needs gold individual retirement account investors to keep their gold with an IRS-approved custodian, such as a bank, cooperative credit union, or other banks. If you select to neglect this guideline and keep your gold in the house, your gold will certify as a circulation, suggesting that you may deal with a 10% tax penalty.

Even worse, saving your gold investment in the house might lead to a tax audit, which might require additional penalties from the IRS. If you 'd prefer to own gold and store it any place you want, you might want to purchase gold bullion straight from among the gold individual retirement account suppliers on our list.

Best Gold Ira Companies 2021 - Gold Iras 101

When you get this gold, you can keep it at home, shop it with a custodian, or do whatever you desire with it. Which IRS-approved coins can you keep in a gold IRA? As we mentioned earlier, the metals you buy for an individual retirement account investment should fulfill particular IRS standards for quality and purity (gold etf).

The Internal revenue service acknowledges specific gold bullion and other valuable metal coins as meeting these requirements. The IRS accepts the following gold coins for gold IRAs: American Gold Eagle bullion and evidence coins American Gold Buffalo uncirculated coins Chinese Gold Panda coins Australian Kangaroo/Nugget coins Canadian Gold Maple Leaf coins Austrian Gold Philharmonic coins When you work with a trusted gold Individual retirement account service provider, you can feel confident that the gold you buy will meet Internal revenue service standards.

Many IRA providers charge a preliminary account setup cost that covers the work involved in developing your financial investment account. This fee usually ranges from $50 to $150. Some business waive this fee for bigger investment deposits. Next, many IRA business charge a yearly administrative fee that covers the expense of keeping your account open year after year.

Gold Etf

How do beginners buy gold?

How to buy gold stock

Can I buy gold at the bank?

No, there are only a limited number of banks that are authorized to sell gold. In addition, most banks don't sell physical gold but digital gold only. So, if you want to buy gold from a bank, you need to call them and confirm whether they sell gold or not.

What will be the gold rate in 2022?

Gold rates today, 25 March 2022: Gold rates in Delhi per 10 grams of 22 carats is at Rs. 47,340 and the rate of 10 grams of 24 carats is at Rs. 51,660.

Which country is best for buying gold?

So, for the love of gold and shopping, check out the 5 best places in the world Continueddirected ira to buy gold.

Dubai, UAE. When you go to website think of Dubai, the idea of buying gold surely directed ira pops up immediately.

Bangkok, Thailand.

Hong Kong, China.

Cochin, India.

Zurich, Switzerland.

Finally, you'll need to pay a storage cost to the depository that holds your investment. Some custodians charge a flat annual fee, while others base their storage fees on the quantity of gold in the account. On top of these basic charges, IRA providers can pick whether to charge a commission for buying gold for their customers.

Lots of financiers find that the advantages of gold investing make these greater costs worth the expense. Where are the precious metals inside your gold individual retirement account stored? When you open a gold IRA account, you will need to keep your financial investment with a custodian, such as a bank. However, you can choose which custodian will hold your gold for you.

You can pick to work with these custodians or various ones. In any case, we recommend asking a depository for its licenses and registrations prior to you trust it with your gold financial investment. Stopping working to carry out these background checks may place you at threat of losing your financial investment completely. Last thoughts Buying a gold IRA is an outstanding method to diversify your retirement portfolio and decrease the volatility of your possessions.

A Guide On How To Find Best Gold Ira Companies

If you're still uncertain which IRA company is the very best gold individual retirement account company for your requirements, we recommend asking for the complimentary brochure from each supplier and comparing the benefits and disadvantages of each organization. However, due to the fact that all of these companies provide similar services, you can't fail selecting any of them to facilitate your gold IRA investment.

Take a look at the business on our list today to begin the process of rolling over funds from an existing retirement account to a more steady gold individual retirement account - top gold investment companies. * This short article is offered by an advertiser and not necessarily composed by a monetary advisor. Investors need to do their own research on items and services and get in touch with a monetary consultant before opening accounts or moving cash.